Financing Your ADU Project: Navigating the Path to Your Dream Backyard Home

So, you’ve taken the exciting step of considering an accessory dwelling unit (ADU) for your property. That’s fantastic news! As an ADU Financing Consultant at HomeFirst Mortgage Bankers with a keen eye on the industry, I’m here to help you unravel the complexities of financing your ADU project.

Embarking on an ADU journey is undoubtedly exhilarating, but let’s address the elephant in the room: financing. Let’s be honest; building an ADU involves a significant financial commitment. From construction costs to permits and planning, it’s essential to be prepared for the financial demands that come with this endeavor.

The Impact of Market Trends

Before we dive into financing options, it’s important to grasp the influence of market trends on ADU costs. Over the past couple of years, we’ve witnessed a notable rise in construction costs. Building an ADU is a substantial investment, and very few ADUs are completed for less than a couple hundred thousand dollars. Keep in mind that beyond the labor and materials costs, you’ll also need to cover planning and permitting expenses. It’s not uncommon for homeowners to allocate $20,000 to $30,000 for the design and permitting process alone.

According to data from Verisk Analytics, labor and materials expenses escalated by over 11% in 2021 and 9% in 2022, largely propelled by volatile lumber prices. In addition, construction labor costs have surged by a substantial 34% over the last five years.

But here’s an interesting twist: higher interest rates have actually become a driving force for the ADU market. With traditional homes becoming less affordable for first-time buyers, ADUs are emerging as a viable solution for homeowners seeking additional living space or rental income.

Exploring Financing Avenues

Now, let’s delve into the world of ADU financing options. Each path comes with its own set of advantages and considerations:

- Bank Loans: While there isn’t a specialized ADU loan product, adapting existing home-finance options is a common approach. However, keep in mind that the novelty of permitted ADUs and appraisal processes can impact the loan amount you qualify for.

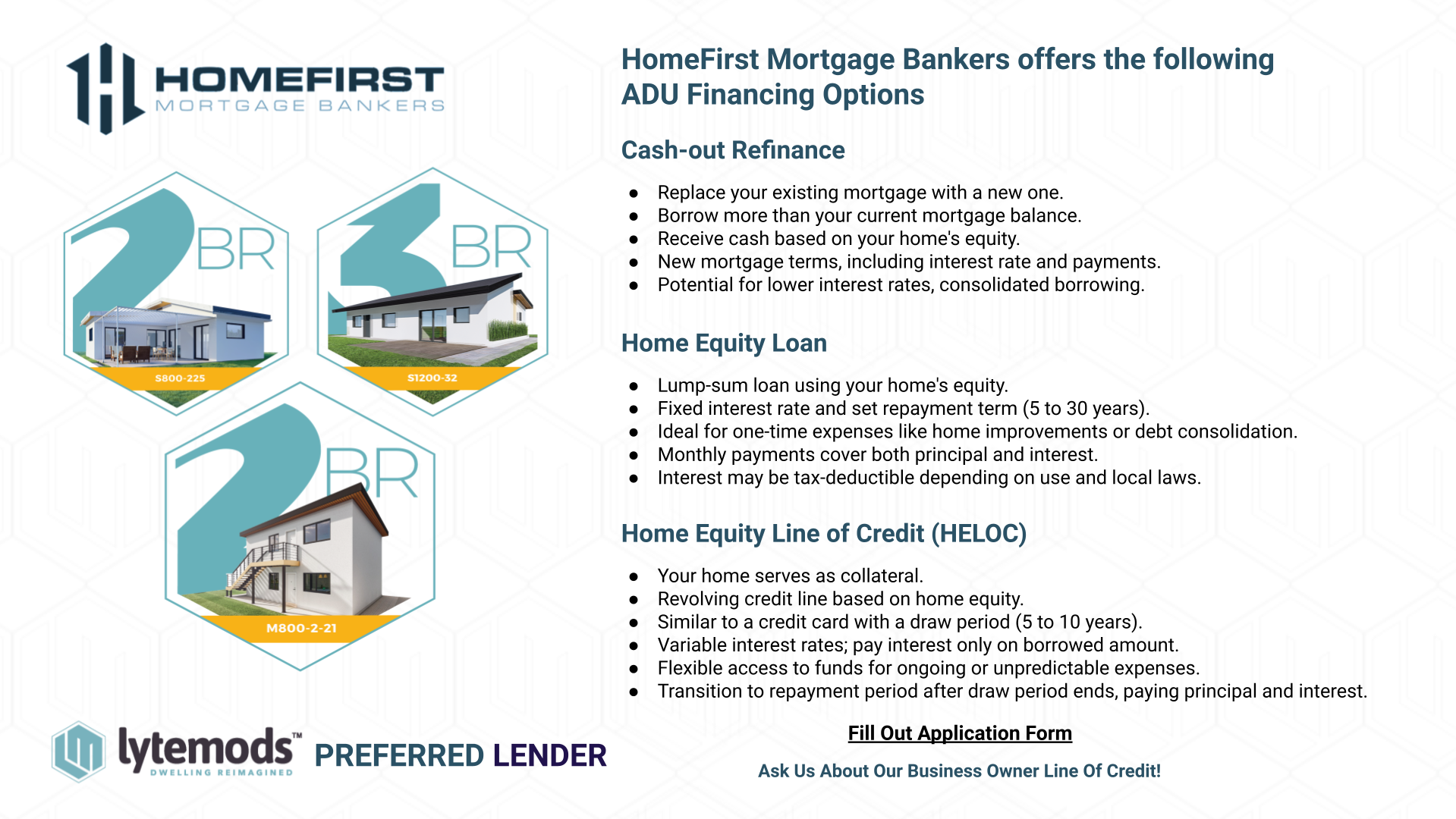

- Cash-out Refinancing: This involves refinancing your current mortgage and rolling the ADU costs into the new loan. It’s a practical solution, though the interest rate might be slightly higher than a traditional mortgage.

- Home Equity Loan or Line of Credit: If your home’s equity has experienced a boost due to the market, tapping into it through these options is worth considering. While interest rates might be a bit higher, closing costs tend to be more manageable.

- Construction Loans: Short-term loans disbursed as work progresses can provide the flexibility you need. However, be prepared for slightly elevated interest rates and the potential requirement for a significant down payment.

- Renovation Loans: These can be a speedy option, but they often come with higher interest rates compared to traditional mortgages.

Expert Guidance: Your North Star

Navigating ADU financing can be intricate, but you don’t have to go it alone. Seeking guidance from experts in the field can make a world of difference. Nonprofit housing advocacy groups, certified counselors from federal agencies, or specialized firms like HomeFirst Mortgage Bankers can provide invaluable insights and tailor financing solutions to your specific needs.

Remember that your ADU has the potential to generate rental income, but local regulations may impact your plans for short-term rentals.

As you venture into the world of ADU financing, remember that every homeowner’s journey is unique. Despite the challenges, the ADU market is ripe with opportunities, driven by evolving housing needs and creative financing solutions.

At HomeFirst Mortgage Bankers, we’re here to assist you every step of the way. With a deep understanding of ADU financing, we’re committed to helping you turn your ADU aspirations into a reality. Your property has the potential to become not just a plot of land, but a hub of living possibilities through the magic of ADUs.

Contributor: